by Harry | Feb 19, 2019 | Tax Tips & Tricks

Did you know that you can amend a tax return? If you notice that you made an error on a tax return you already filed, you can (and should) amend your return to make sure you don’t run into trouble with the IRS. If you do need to amend your tax return, there are some...

by Harry | Dec 15, 2018 | Tax Tips & Tricks

Tax mistakes are not uncommon. Lots of people make them. They can be costly if you don’t have someone to help you through the rough spots. Even knowing that you have someone to guide you through the consequences resulting from a tax mistake, you still want to...

by Harry | Dec 4, 2018 | Tax Tips & Tricks

As you probably already know, winning the lottery can mean millions of dollars and the realization of your wildest dreams. But, can lottery winnings also mean added headaches when tax time rolls around? The Lottery and Taxes People tend to get very excited when there...

by Harry | Nov 27, 2018 | Tax Tips & Tricks

A lot of people find joy in being self-employed. Because you can be your own boss, be able to work at your own pace, and have some extra time for enjoyment without worrying about other things. But of course, if there is one thing you must remember when you are...

by Harry | Nov 21, 2018 | Tax Tips & Tricks

When a married couple signs a joint tax return, they are signing a legal document that will hold both signatories in joint and several liability. That applies to the information shown on the return. Next, the spouse of each person can be held liable for the entire tax...

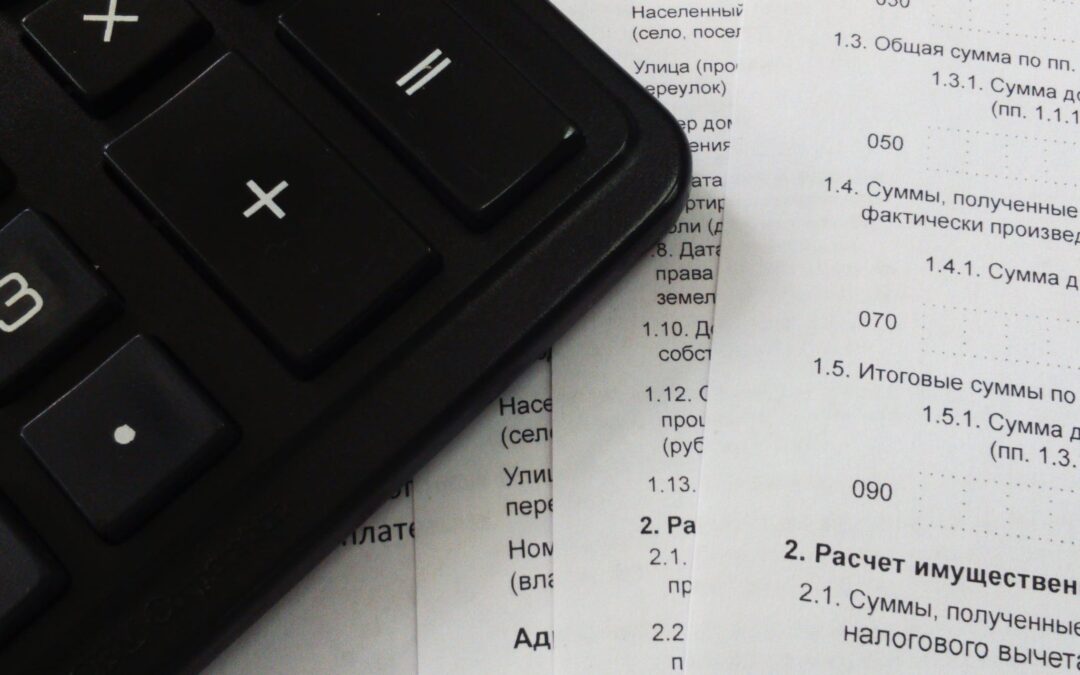

by Harry | Nov 18, 2018 | Tax Tips & Tricks

The IRS requires you to report your foreign financial account(s) yearly to the Department of Treasury once it has exceeded certain thresholds. Included in the list of accounts to be reported are brokerage, mutual fund, and bank accounts. This can be filed...